International Ambitions, IRS Realities: U.S. Persons and Foreign Corporation Investments

1st Published as "U.S. Persons And Their Investments In Foreign Corporations" in 2014. [Updated-2025] Not glamorous, but it’s essential if you want to keep your international ventures in compliance.

The world feels smaller than ever.

With a few clicks, you can run a business across continents, sign clients in different time zones, and build your dream from anywhere.

But while global entrepreneurship is more accessible, it also comes with a set of rules—especially from the IRS.

Before you dive into your next international deal, here’s a reality check: missing your Form 5471 filing isn’t just a paperwork slip—it can trigger steep penalties and unwanted attention from the IRS.

Timely, accurate reporting isn’t optional; it’s your best defense against fines and frustration.

If you’re a U.S. taxpayer with ties to foreign companies, keep reading. This guide breaks down what you need to know for 2025, so you can spend more time growing your business—and less time worrying about tax surprises.

What is Form 5471?

Form 5471 is the IRS’s way of keeping tabs on Americans with foreign business connections. If you’re involved with a foreign corporation, this form is your official check-in. It’s not glamorous, but it’s essential if you want to keep your international ventures running smoothly—and penalty-free.1

Form 5471, “Information Return of U.S. Persons With Respect to Certain Foreign Corporations,” is required filing for U.S. persons who are officers, directors, or shareholders in certain foreign corporations.

This form satisfies reporting obligations under §§ 6038 and 6046 of the Internal Revenue Code. The primary goal is to prevent tax evasion through offshore entities and to ensure all worldwide income is reported to the IRS.

You must file Form 5471 if you meet the criteria for any of the five categories of filers defined by the IRS.

The form is attached to your annual income tax return and is due by the same deadline—including extensions.

A separate Form 5471 and all applicable schedules must be filed for each foreign corporation you are required to report.

Categories of Filers [Updated for 2025]

Not everyone with a foreign business has the same filing responsibilities. The IRS sorts people into categories, and your category shapes what you need to report. It’s worth taking a few minutes to figure out where you fit—because guessing wrong can be costly.

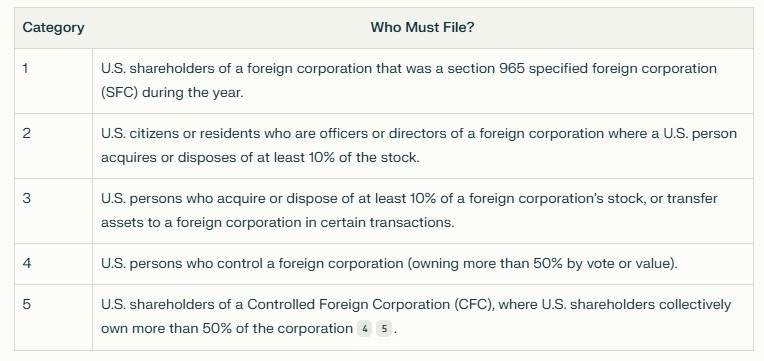

Form 5471 requirements are divided into five categories, each with specific criteria based on ownership, control, and role within the foreign corporation:

Ownership can be direct, indirect, or constructive, so shares held by related persons or entities may count toward your total ownership, even if not held in your name.

What is a CFC (Controlled Foreign Corporation)?

If U.S. shareholders own more than half of a foreign company, the IRS calls it a Controlled Foreign Corporation, or CFC. This label comes with extra reporting rules, so if your business crosses this line, make sure you’re on top of your paperwork.2

Key Filing Deadlines

Deadlines matter. The IRS is strict about timing, and missing a due date can mean automatic penalties. Make sure you know your filing deadline—and give yourself a buffer to avoid last-minute stress.

Exceptions from Filing Form 5471

There are a few exceptions that might let you off the hook, but don’t assume you qualify without double-checking. The rules are detailed, and a small oversight could lead to big headaches later.

Some exceptions apply, including:

Multiple Filers of the Same Information: One filer may submit Form 5471 and schedules for others with identical requirements, but all involved must follow IRS instructions for disclosure.

Constructive Owners: Certain constructive owners [especially Category 5] may be exempt if the U.S. person through whom they own the foreign corporation files all required information.

Domestic Corporations: Shareholders of a foreign insurance company treated as a domestic corporation under section 953(d) may be exempt.

Members of Consolidated Groups: Category 4 filers are not required to file for corporations included in a consolidated return.

Dormant Foreign Corporations: Inactive corporations may qualify for limited filing relief.

Always review the latest IRS instructions or consult a tax professional to confirm exceptions for your situation.

Additional Filing Requirements

Sometimes, Form 5471 isn’t the only form you’ll need. If your situation involves special elections, transactions, or other foreign assets, expect a few more hoops to jump through.

Staying organized is your best friend here.

Category 3 Filers: Special rules apply for those transferring assets or stock to a foreign corporation.

Foreign Sales Corporations (FSCs): Certain officers, directors, and shareholders have extra requirements.

Section 338 Elections: Additional disclosures if a qualified stock purchase election is made.

Reportable Transactions: Form 8886 may be required for certain transactions, with significant penalties for non-compliance.

Foreign Financial Assets: Form 8938 may also be required if you meet reporting thresholds for foreign assets.

Penalties for Non-Compliance

The IRS means business when it comes to international reporting. Even an honest mistake can lead to steep fines. If you want to avoid unnecessary costs and stress, timely and accurate filing is non-negotiable.

Failing to file Form 5471, or filing it incorrectly or late, can result in severe penalties:

Starting at $10,000 per form, per year.

Additional $10,000 penalties for each 30-day period after IRS notification, up to $50,000.

Both civil and criminal penalties may apply for willful violations.

Tips for 2025 Compliance3

Start early, stay organized, and don’t be afraid to ask for help.

International tax rules are complex, but a proactive approach—and a good advisor—can keep you confident and compliant.

Double-check your category: Filing requirements and schedules vary by filer category.

Prepare early: Gather all necessary information well before the deadline.

File even for dormant corporations: Filing is required even if the foreign corporation had no activity or income.

Use correct exchange rates: Convert foreign currency using 2024 rates for the 2025 tax year.

Seek professional help: Given the complexity, professional guidance is strongly recommended.

Bottom Line

Doing business across borders is full of opportunity—but also full of fine print. Don’t try to navigate international tax rules alone. Partner with a cross-border tax specialist who understands the ins and outs and can keep you on the right side of the IRS.

And if you want more practical tips and updates for global entrepreneurs, make sure to follow my account—you’ll always be one step ahead when it comes to smart, compliant business growth