The Mysterious Forms 1099 Unveiled!

Also included: Bonus bits on Forms 1099-NEC; 1099-K; and FATCA reporting!Let me take you back to one of my earliest tax prep memories: a client walked into the office with a shoebox full of 1099's...

🎯 What to Do When You Get a 1099-MISC, 1099-NEC, or 1099-K in 2025

Let me take you back to one of my earliest tax prep memories: a client walked into the office with a shoebox full of 1099-MISC forms—yes, a literal shoebox! Each one was issued under his Social Security Number, and we spent hours sorting through them. It was chaotic, but it taught me everything I needed to know about this mysterious form.

Fast forward to today, and the 1099 family has grown—and evolved.

So, what do you do when one of these forms lands in your mailbox (or inbox) in 2025?

Let’s break it down.

🧾 What Is Form 1099-MISC?

Form 1099-MISC (Miscellaneous Information) is used to report various types of income that don’t fit neatly into other categories. You might receive one if you were paid:1

$10 or more in royalties or broker payments

$600 or more in:

Rent

Prizes or awards

Medical or health care payments

Crop insurance proceeds

Payments to attorneys

Other miscellaneous income

Or if you sold $5,000+ in consumer products for resale outside a retail store

But here’s the twist: Non-Employee Compensation—once reported in Box 7 of this Form 1099-MISC—has moved to its own form.

💼 Meet Form 1099-NEC

Since 2020, Form 1099-NEC (Nonemployee Compensation) has taken over reporting for freelancers, gig workers, and independent contractors. If you earned $600 or more for services and weren’t on payroll, this is the form you’ll get.

You’ll typically report this income on Schedule C, and yes—you can deduct business expenses. 2

Just make sure you keep detailed records. The IRS pays close attention to this area.

💳 What About Form 1099-K?

If you’ve been paid through platforms like PayPal, Venmo, Stripe, or Square, etc. you might receive a Form 1099-K. This form reports payments processed through third-party networks or credit cards.

As of 2025, the IRS requires a 1099-K if:

You received over $5,000 in payments via these platforms (regardless of the number of transactions)

⚠️ Important: Not all 1099-K income is taxable. If you used Venmo to split rent or get reimbursed for dinner, that’s not business income—but you’ll need documentation to prove it.3

🧠 What Should You Do If You Receive One?

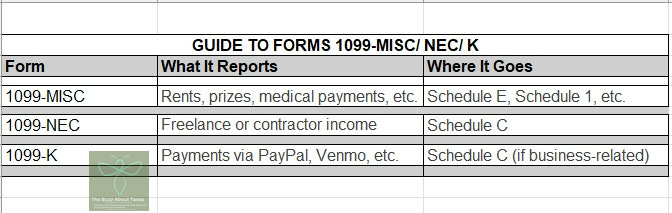

Here’s a quick guide:

If you’re unsure, don’t guess—ask a tax pro. Misreporting can lead to penalties or missed deductions.

🌍 FATCA Reporting Requirements

Beginning in 2014, a Foreign Financial Institution [FFI] with a Chapter 4 requirement to report a U.S. account maintained by them, and held by a specified U.S. person may satisfy this requirement by reporting on Form 1099-MISC.

Also, a U.S. payor may satisfy its Chapter 4 requirement to report such a U.S. account by reporting on Form 1099-MISC.

A new check box was added to Form 1099-MISC to identify an FFI filing this form. So, if you receive a Form 1099-MISC with a check in the box "FATCA Filing Requirement", examine your filing thresholds for FinCEN Form 114 and/ or Form 8938. More about these thresholds in my blog posts here, here and here.

💬 Final Thoughts

Getting a 1099 form can feel overwhelming—but it doesn’t have to be.

Whether it’s a 1099-MISC, 1099-NEC, or 1099-K, the key is to understand what it means, track your income, and stay organized.

And if you’re ever in doubt? That’s what tax professionals are here for.

We’ve seen it all—even shoeboxes full of forms.

Form 1099-K- Myths vs facts - IRS- Fact Sheet